In the world of investments, the term “lock-in period” often appears, especially with mutual funds, and is crucial for anyone aiming to invest wisely. This article breaks down what a lock-in period is, its relevance in mutual fund investments—particularly for the Equity Linked Savings Scheme (ELSS)—and what investors in India should consider when investing.

What is a Lock-In Period?

A lock-in period in mutual funds refers to a predetermined duration during which investors cannot redeem or withdraw their invested amount. This period is set to encourage long-term investment discipline, reduce the urge for premature withdrawals, and allow the investment to grow without interruptions.

For many investment options in India under Section 80C of the Income Tax Act, such as the Public Provident Fund (PPF), tax-saving fixed deposits, and ELSS mutual funds, lock-in periods ensure capital remains in the market long enough to optimize returns and meet certain eligibility criteria for tax benefits.

What is a Lock-In Period?

A lock-in period in mutual funds refers to a predetermined duration during which investors cannot redeem or withdraw their invested amount. This period is set to encourage long-term investment discipline, reduce the urge for premature withdrawals, and allow the investment to grow without interruptions.

For many investment options in India under Section 80C of the Income Tax Act, such as the Public Provident Fund (PPF), tax-saving fixed deposits, and ELSS mutual funds, lock-in periods ensure capital remains in the market long enough to optimize returns and meet certain eligibility criteria for tax benefits.

Lock-In Period for ELSS Mutual Funds

The ELSS mutual fund, a popular investment vehicle for Indian investors, is unique among tax-saving instruments as it offers both tax deductions and the shortest lock-in period of only three years. This shorter lock-in period makes ELSS funds attractive compared to options like PPF, which has a 15-year lock-in, or tax-saving fixed deposits with five years.

Types of Mutual Funds with Lock-In Periods

Not all mutual funds in India come with a lock-in period. However, ELSS mutual funds are a prime example of locked-in funds due to their Section 80C tax benefits. Other non-tax-saving funds, such as equity, debt, or hybrid funds, typically do not have a lock-in period, offering more liquidity and flexibility.

How Does the Lock-In Period Work in ELSS Investments?

An ELSS investment’s lock-in period can function differently based on how you choose to invest:

Lump-Sum Investment: When an investor makes a lump-sum investment, the three-year lock-in period is counted from the date of that one-time purchase. For example, an investment made on January 1, 2021, becomes eligible for redemption only after January 1, 2024.

Systematic Investment Plan (SIP): A SIP allows investors to invest a fixed amount in ELSS funds monthly. Here, the lock-in period applies individually to each installment, so each SIP contribution has its own three-year lock-in. For instance, if you invested on January 1, 2021, and made a subsequent investment on February 1, 2021, the lock-in period would end on January 1, 2024, for the first investment and February 1, 2024, for the second.

How Does the Lock-In Period Work in ELSS Investments?

A lock-in period is often seen as restrictive, but it serves multiple benefits for ELSS funds:

Tax Benefits: ELSS funds qualify for a tax deduction of up to ₹1.5 lakh under Section 80C, enabling tax savings of up to ₹46,800, depending on the tax bracket. ELSS funds thus combine equity-linked growth potential with tax savings.

Potential for Higher Returns: Since ELSS funds invest primarily in equities, the lock-in period provides time for the markets to potentially deliver better returns, mitigating short-term volatility.

Long-Term Wealth Creation: Equity investments benefit from compounding over time. A three-year lock-in encourages investors to stay invested, potentially leading to wealth creation, especially if the market performs well.

What Happens After the Lock-In Period Ends?

Once the lock-in period of three years is over, investors are not obligated to redeem their investments. After the lock-in, the ELSS fund becomes an open-ended equity fund, meaning you can choose to withdraw, partially redeem, or continue holding your units in the fund.

Redeem or Stay Invested?

Deciding whether to redeem or stay invested depends on:

- Fund Performance: If the ELSS fund has consistently performed well, it might be beneficial to keep the investment growing.

- Market Conditions: If the equity markets are favorable, staying invested could allow further appreciation.

- Financial Goals: If your financial goals align with longer investment horizons, holding your investment can be wise.

Things to Consider Before Investing in ELSS Funds with a Lock-In Period

While ELSS funds are an excellent choice for tax-saving purposes and have the shortest lock-in among Section 80C options, a few considerations are essential:

- Risk Tolerance: As ELSS funds invest primarily in equities, they come with inherent market risks. Investors should assess their risk appetite before locking funds for three years.

- Diversification: ELSS funds should be part of a diversified portfolio. Relying solely on them may expose your portfolio to higher risk due to equity exposure.

- Exit Strategy: Plan your investment with an exit strategy in mind. After three years, based on fund performance and your financial requirements, decide on whether to redeem or continue.

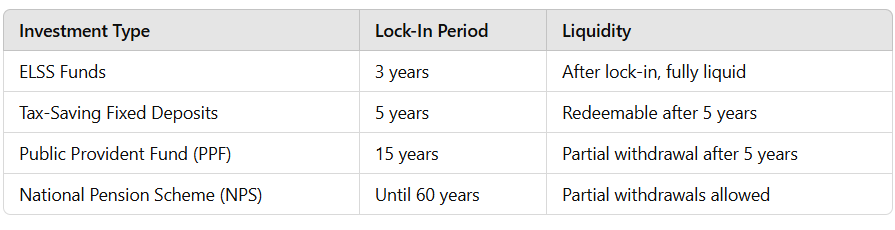

Comparing Lock-In Periods of Popular Investment Options in India

Here’s a quick comparison of various tax-saving options under Section 80C in terms of their lock-in periods and liquidity:

Key Takeaways

- ELSS Funds and Tax Benefits: ELSS funds are popular for providing tax deductions under Section 80C and carry the shortest lock-in period (3 years) among other options.

- Lump-Sum and SIP Lock-In: Each SIP installment in ELSS has an individual lock-in period, while lump-sum investments follow a single lock-in timeline.

- Post Lock-In Flexibility: Once the lock-in period ends, ELSS funds become open-ended, giving investors the flexibility to redeem or stay invested based on fund performance and personal goals.

Final Thoughts

The lock-in period in mutual funds, especially in ELSS funds, balances tax savings and long-term investment benefits. For Indian investors, ELSS funds represent a compelling blend of equity-based growth potential, tax relief, and liquidity after a relatively short lock-in period. Understanding the nuances of the lock-in period enables you to make well-informed investment decisions, aligning both with your tax-saving needs and long-term wealth-building aspirations.

Investing in mutual funds always comes with risks; however, a lock-in period in funds like ELSS can encourage disciplined investing, offering the dual benefits of tax savings and capital growth over time.