What is XIRR in Mutual Funds and How Does It Impact Your Returns?

Investing in mutual funds has become increasingly popular among Indians looking to build wealth and achieve financial goals. With a variety of mutual funds suited for different risk profiles, this investment avenue offers both flexibility and convenience. One essential metric for measuring returns on these investments is XIRR in mutual funds. But what exactly is XIRR, and why is it so important for mutual fund investors? Let’s explore everything you need to know about XIRR in mutual funds, from its definition to its calculation and importance in financial planning.

1. What is XIRR in Mutual Funds?

XIRR, or Extended Internal Rate of Return, is a method used to calculate the overall return on investments with multiple transactions at different times. Unlike a simple annualized return, XIRR in mutual funds takes into account the timing and size of each investment, making it particularly useful for investments that involve irregular cash flows—like systematic investment plans (SIPs) and partial withdrawals in mutual funds.

In India, SIPs have become a preferred choice for mutual fund investors, allowing them to invest a fixed amount at regular intervals, usually monthly. Since each SIP installment occurs on a different date and grows at a different rate, calculating returns can get complicated. XIRR in mutual funds simplifies this by taking into account each cash flow, ultimately providing a single percentage return that accurately reflects the investment’s overall performance.

2. Why is XIRR Important for Mutual Fund Investors?

For investors using SIPs or making staggered investments in mutual funds, accurately measuring returns is crucial. XIRR in mutual funds offers an accurate assessment of returns by:

Reflecting Returns on Staggered Investments: SIPs, additional investments, and withdrawals all affect returns. XIRR considers each cash flow, ensuring that your return calculation is accurate despite irregular transactions.

Enabling Easy Comparisons: With XIRR in mutual funds, investors can easily compare returns across different funds or investment options, as it considers the exact timing of cash flows rather than assuming an even distribution over time.

Supporting Financial Goal Planning: By understanding the XIRR of your mutual fund investments, you can better gauge whether your portfolio is on track to achieve long-term goals such as retirement, child’s education, or wealth accumulation.

3. How Does XIRR Work in Mutual Funds?

While XIRR may seem complex at first, it essentially builds on the concept of IRR (Internal Rate of Return) but is adapted for investments with irregular cash flows. Here’s how XIRR in mutual funds works:

Considers Timing and Amounts: XIRR looks at each investment (or withdrawal) alongside its date. For instance, if you invested ₹10,000 on January 1, ₹15,000 on March 1, and redeemed ₹5,000 on June 1, XIRR calculates each of these cash flows separately.

Arrives at a Single Rate of Return: XIRR finds a single rate that balances all cash inflows and outflows, factoring in the specific dates of each transaction.

Accuracy Over Simple Returns: Unlike a straightforward annualized return, which assumes uniform growth, XIRR provides an accurate rate of return by considering the actual timing and pattern of cash flows.

Essentially, XIRR in mutual funds offers a customized measure of returns based on your unique investment history, a level of accuracy that standard annualized returns can’t match.

4. Calculating XIRR: A Step-by-Step Example

To understand how XIRR in mutual funds is calculated, let’s go through a simplified example:

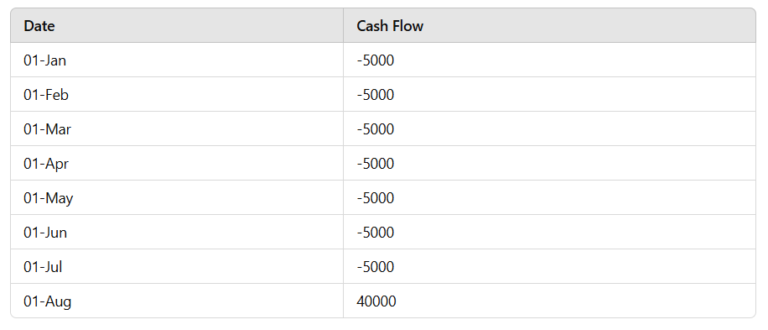

Suppose Rajesh starts a SIP of ₹5,000 per month in a mutual fund on January 1. He continues investing monthly until July 1, completing seven installments. On August 1, he withdraws ₹40,000. Here’s how XIRR in mutual funds would calculate his returns:

List Each Cash Flow: Each SIP installment of ₹5,000 is treated as an investment, and the redemption of ₹40,000 as an outflow.

Consider Dates: The date of each investment and redemption is crucial. Though each installment is ₹5,000, their returns vary based on the time in the market.

Calculate XIRR in Excel: The simplest way to calculate XIRR is by using Excel’s XIRR function. By entering the cash flows and corresponding dates, Excel calculates the XIRR, providing a single return percentage.

For example:

When entered into Excel’s XIRR function, these cash flows yield a rate of return that accounts for both the timing and size of each transaction.

5. XIRR vs CAGR: Key Differences

Investors often wonder: How is XIRR in mutual funds different from CAGR (Compound Annual Growth Rate)? Although both methods calculate returns, they are suited for different scenarios:

CAGR is ideal for calculating returns on a lump-sum investment with no additional cash flows, providing a “smooth” rate of growth over time.

XIRR, on the other hand, is designed for irregular cash flows like SIPs and partial withdrawals, making it more accurate for mutual fund investors with varying investment patterns.

For SIP-based mutual fund investments, XIRR in mutual funds is the preferred metric as it adapts to each investment’s unique cash flow pattern.

6. How to Use XIRR for Better Mutual Fund Decisions

Knowing XIRR in mutual funds can help investors make smarter decisions:

Evaluating Fund Performance: Regularly check the XIRR of your investments to assess performance and determine if your portfolio aligns with your financial objectives.

Setting Financial Milestones: Use XIRR as a benchmark to monitor your progress toward specific goals. For example, if you aim for a 12% return on your SIP investments, monitoring XIRR can indicate if you’re on track.

Comparing Funds Effectively: With XIRR, you can make meaningful comparisons across funds, helping you identify which funds best suit your needs based on real returns.

7. Tools to Calculate XIRR in Mutual Funds

lthough calculating XIRR manually can be challenging, there are many tools to make the process simple for investors:

Excel or Google Sheets: Both offer a built-in XIRR function, which can calculate returns accurately based on cash flows and dates.

Mutual Fund Platforms: Popular platforms like Groww and Zerodha typically display XIRR directly for each investment, allowing investors to monitor returns easily.

Online Calculators: Several financial websites provide free XIRR calculators where you can input your cash flows and dates for instant results.

8. Key Takeaways on XIRR in Mutual Funds

XIRR in mutual funds is essential for SIP investors, providing a true measure of returns that factors in the timing of each transaction.

Unlike CAGR, which assumes a single investment, XIRR considers each cash flow, making it more relevant for mutual fund investors.

Using XIRR helps evaluate fund performance, compare funds, and track progress towards financial goals effectively.

Conclusion

In summary, XIRR in mutual funds is a vital tool for Indian investors, particularly those investing through SIPs. By calculating a return that accounts for each investment’s timing and size, XIRR provides an accurate picture of performance, enabling investors to make informed decisions and set realistic goals. Whether you’re new to mutual funds or a seasoned investor, understanding and tracking your XIRR can give you confidence and clarity on your path to financial growth.

Embrace XIRR in mutual funds as a core metric in your investment journey to maximize returns and achieve your financial dreams in the ever-growing world of mutual fund investing in India.