Sukanya Samriddhi Yojana vs. Mutual Funds: Understanding the Differences

When planning a secure financial future for your child, especially a daughter, Sukanya Samriddhi Yojana (SSY) and Mutual Funds emerge as two popular investment options. While both serve long-term financial goals, they differ significantly in terms of risk, returns, tax benefits, and flexibility. Below, we provide a detailed comparison to help you make an informed decision based on your financial goals and risk tolerance.

1. Sukanya Samriddhi Yojana: An Overview

Launched by the Government of India, Sukanya Samriddhi Yojana is a small savings scheme designed exclusively for girl children. Its primary aim is to encourage parents to save for their daughter’s higher education or marriage.

Key Features

- Eligibility: Available to girls under 10 years of age. A maximum of two accounts can be opened per family, with exceptions for twins/triplets.

- Investment Range: The minimum deposit is ₹250 annually, while the maximum is ₹1.5 lakh per year.

- Interest Rate: As of 2024, the interest rate is 8.2% per annum, compounded annually, making it one of the highest among fixed-income options.

- Tenure: The account matures when the girl turns 21 or upon her marriage after 18. Partial withdrawals are allowed after 18 years, primarily for higher education.

- Tax Benefits: Contributions, interest earned, and maturity amounts are exempt from taxes under Section 80C of the Income Tax Act.

Pros

- Guaranteed returns, unaffected by market fluctuations.

- Triple tax exemption (investment, interest, and withdrawal).

- Encourages disciplined, long-term saving.

Cons

- Restricted to girl children only.

- Rigid withdrawal rules until the girl turns 18.

- Returns may not outpace inflation significantly over time.

2. Children’s Mutual Funds: An Overview

Children’s mutual funds are market-linked financial instruments that allow parents to invest in equity, debt, or a combination of both. These funds aim to generate wealth for specific goals such as education, marriage, or other significant expenses.

Key Features

- Eligibility: Parents or legal guardians can invest on behalf of a child. The child gains control upon turning 18.

- Investment Flexibility: There’s no upper limit, and contributions can start as low as ₹500 through Systematic Investment Plans (SIPs).

- Returns: Historically, equity-oriented mutual funds have offered annualized returns of 10%-12% over the long term, albeit with market risks.

- Tenure: Flexible, but some funds have a lock-in period of 5 years or until the child turns 18.

- Taxation: Capital gains are taxed based on the holding period (short-term or long-term), with benefits of indexation reducing the tax burden for long-term gains.

Pros

- Potential for higher returns compared to SSY, especially over long investment horizons.

- Flexibility to choose investment type (equity, debt, or hybrid) based on risk appetite.

- No restriction on who can benefit; suitable for both boys and girls.

Cons

- Returns are not guaranteed due to market volatility.

- Requires a certain risk tolerance and understanding of financial markets.

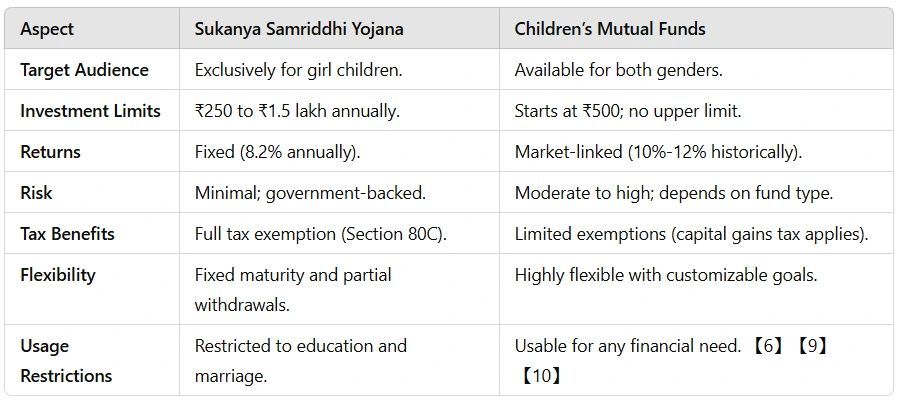

3. Comparative Analysis

4. Who Should Choose What?

Sukanya Samriddhi Yojana: Ideal for risk-averse investors seeking guaranteed returns and long-term financial security for their daughters’ futures. It is particularly suited for parents who prioritize tax savings and fixed-income investments.

Children’s Mutual Funds: Best for parents with a moderate to high risk tolerance looking for potentially higher returns to combat inflation. These funds provide the flexibility to adjust portfolios according to changing financial goals and market conditions.

5. Final Thoughts

Both Sukanya Samriddhi Yojana and Children’s Mutual Funds have their unique advantages. The choice depends largely on your financial goals, investment horizon, and risk appetite. Combining both options can also be a strategic approach—using SSY for guaranteed returns and mutual funds for wealth creation.

Before making any investment, it’s essential to assess your financial goals, consult a financial advisor if needed, and understand the specific terms and conditions of each scheme.

By striking the right balance between safety and growth, you can secure a bright and prosperous future for your child.