Cost of Delay: Why Time Matters in Investment Decisions

When it comes to wealth creation, the cost of delay is a critical yet often overlooked concept, especially in the realm of mutual funds. This term refers to the financial impact of postponing investments and how it can drastically affect your long-term financial goals. By understanding the implications of the cost of delay, you can better appreciate the importance of starting your investment journey early.

Mutual Funds: A Path to Financial Growth

Mutual funds are an investment vehicle that pools money from multiple investors to invest in stocks, bonds, or other assets. They are popular due to their potential for high returns and accessibility through options like Systematic Investment Plans (SIPs). However, the real power of mutual funds lies in their ability to harness the benefits of compounding, which grows exponentially over time. Delaying your investments can lead to significant opportunity costs, reducing the wealth you could have accumulated.

What is the Cost of Delay?

The cost of delay refers to the wealth forfeited due to postponing an investment. This could mean delaying a SIP or deferring a lump sum investment, both of which reduce the time available for compounding. Even a short delay can lead to a stark difference in the accumulated corpus at the end of your investment horizon. For instance:

- Starting a SIP of ₹5,000 at 25 could grow to ₹1.9 crore by 60 at a 10% annual return.

- Delaying the same SIP until 30 reduces the corpus to ₹1.1 crore, a loss of ₹80 lakh

How Does the Cost of Delay Impact Mutual Fund Investments?

1. Reduced Compounding Benefits

The power of compounding grows exponentially over time. Delaying your investment even by a few years can drastically diminish the compounding effect, resulting in a lower corpus.

2. Higher Contributions Required

To make up for the lost time, late investors often need to contribute significantly more. For example, starting at 35 instead of 25 may require doubling your monthly SIP to achieve the same corpus.

3. Missed Financial Goals

Delaying investments can jeopardize your ability to meet long-term goals such as retirement planning, home purchases, or funding higher education

Real-Life Example: The Cost of Delay in SIPs

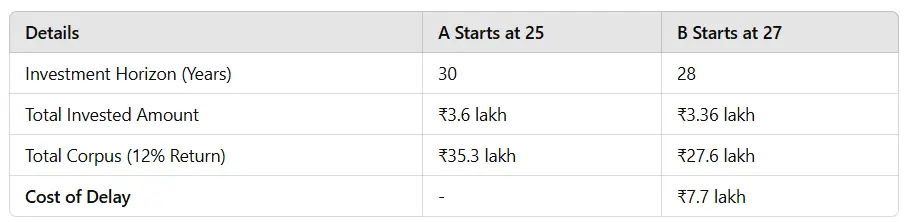

Let’s consider two investors, A and B, who plan to invest ₹1,000 monthly in a mutual fund SIP:

This table illustrates that even a two-year delay results in a significant loss, underscoring the importance of starting early

Benefits of Starting Early in Mutual Funds

- Time Advantage: Longer investment horizons amplify the compounding effect.

- Smaller Contributions Needed: Early investments require smaller regular contributions to achieve the same goals.

- Flexibility to Adjust: More time allows for experimentation with different mutual fund strategies.

- Achieving Financial Goals Comfortably: Early and consistent investments make it easier to meet life’s major milestones

How to Avoid the Cost of Delay

- Start Small: Even small SIPs can grow substantially over time.

- Leverage Tools: Use cost of delay calculators to understand the financial impact of delays.

- Set Clear Goals: Having defined financial objectives can motivate you to start investing early.

- Automate Investments: SIPs help ensure disciplined investing without requiring constant decision-making.

Conclusion

The cost of delay in mutual funds is a stark reminder of the financial advantage of starting early. The longer you wait, the more you forfeit the exponential benefits of compounding. Whether you opt for SIPs or lump sum investments, starting as soon as possible is the key to building significant wealth over time.

Start your journey today to avoid the cost of delay and secure your financial future!