SIP vs Lump Sum: Which Mutual Fund Strategy is Right for You?

Investing in mutual funds has become increasingly popular in India due to the accessibility and variety of options they offer. Two common strategies that investors use are Systematic Investment Plans (SIP) and Lump Sum investments. Both approaches have their unique advantages and disadvantages, making them suitable for different financial goals and risk profiles.

In this blog, we’ll break down the key differences between SIP and Lump Sum investments, consider how they work in the Indian context, and help you decide which might suit your investment journey.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) allows investors to invest a fixed amount in a mutual fund scheme at regular intervals, typically monthly or quarterly. This investment strategy encourages disciplined saving and takes advantage of market fluctuations through rupee cost averaging.

Key Features of SIP:

– Regular Investments: SIPs allow you to invest regularly, which is particularly beneficial for salaried individuals who have a steady income.

– Rupee Cost Averaging: The principle of buying more units when prices are low and fewer units when prices are high. This helps in averaging the purchase cost over time.

– Power of Compounding: SIPs leverage the power of compounding, as returns earned are reinvested, growing your wealth over the long term.

– Affordability: SIPs are accessible to investors with smaller amounts, as one can start with an amount as low as ₹500.

How SIP Works:

For instance, if you invest ₹5,000 every month in a mutual fund scheme, you purchase more units when the Net Asset Value (NAV) is low and fewer units when the NAV is high. Over time, this helps in averaging out the cost of your investments and minimizes the impact of market volatility.

What is Lump Sum Investment?

A Lump Sum investment involves investing a large amount of money in one go, rather than spreading it out over time. This strategy is ideal for investors who have a significant amount of money available, such as a bonus, inheritance, or savings from another financial avenue.

Key Features of Lump Sum Investment:

– One-Time Investment: You make a single large investment in the mutual fund.

– Potential for Higher Returns: If invested during a market low, lump sum investments can potentially yield higher returns since the entire capital is exposed to market growth from the start.

– Market Timing: This strategy requires good market timing. Investing when the market is high could lead to lower returns.

– Risk Exposure: With a lump sum investment, the entire amount is exposed to market risks from the beginning, making it more susceptible to market fluctuations.

How Lump Sum Investment Works:

For example, if you invest ₹1,00,000 in one go during a market rally, your returns could be high. However, if the market falls soon after your investment, you may face significant short-term losses.

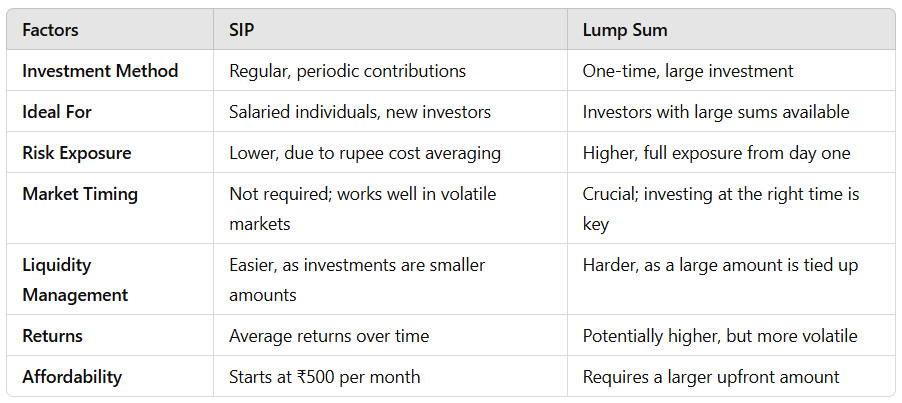

SIP vs Lump Sum: A Comparison

Now that we understand what SIP and Lump Sum investments are, let’s compare them on some crucial factors:

Advantages of SIP

- Disciplined Investing: SIPs help investors inculcate a habit of disciplined investing by ensuring regular contributions.

- Low Market Risk: Rupee cost averaging helps reduce the impact of market volatility, making SIPs a safer choice for risk-averse investors.

- No Need for Market Timing: Since SIPs are spread over time, there’s no need to worry about timing the market perfectly. Even if the market is high at one point, you may still get the benefit of purchasing units when prices drop.

- Flexibility: SIPs allow investors to start small and increase their investment amount later, making it flexible for individuals with varying financial circumstances.

- Suited for Long-Term Goals: SIPs are particularly beneficial for long-term financial goals like retirement planning, children’s education, or buying a home.

Disadvantages of SIP

Average Returns: While SIPs reduce risk, they may also limit the potential for high returns compared to a well-timed lump sum investment during market lows.

Long-Term Commitment: SIPs require a long-term commitment to see significant returns, which might not appeal to investors looking for quick gains.

Advantages of Lump Sum

Potential for High Returns: If the market is performing well, lump sum investments can generate high returns since your entire capital is exposed to growth from the start.

Convenient: For individuals with a large amount of investable funds, lump sum investment offers a convenient one-time investment solution without the need for recurring contributions.

Tax Benefits: If you’re investing in tax-saving mutual funds (like ELSS), lump sum investments offer immediate tax deductions under Section 80C of the Income Tax Act.

Disadvantages of Lump Sum

High Risk: Lump sum investments are more vulnerable to market volatility. If the market takes a downturn soon after the investment, the losses can be significant.

Market Timing is Crucial: Since the entire amount is invested at once, market timing plays a crucial role. A bad timing decision can significantly affect the returns.

Not Suited for Everyone: Lump sum investments require a significant amount of capital and a higher risk appetite, which may not be suitable for all investors.

SIP vs Lum Sum which is right for you?

Choosing between SIP and Lump Sum depends on multiple factors such as your financial goals, market conditions, risk tolerance, and availability of capital.

SIP is generally a better option for investors who have a steady income but may not have large sums of money to invest at once. It’s also ideal for those who want to invest consistently and take advantage of market fluctuations without having to worry about market timing.

Lump Sum is a suitable strategy for investors who have a large amount of capital and are willing to take on higher risk for potentially higher returns. It’s also more beneficial in a bull market or when you can accurately predict a market upswing.

Conclusion

In conclusion, both SIP and Lump Sum investments in mutual funds offer distinct advantages and are suited to different types of investors. The key is to assess your financial situation, risk appetite, and long-term goals before deciding on an investment strategy. For most individuals, a combination of both SIP and Lump Sum may offer the best of both worlds, ensuring steady growth with the flexibility to capitalize on market opportunities when they arise.

Remember, mutual fund investments are subject to market risks, so it’s crucial to do thorough research or consult a financial advisor before making any investment decisions.